Us Cnstitutional Amendment Agains Timposing Income Tax

The Sixteenth Subpoena (Amendment XVI) to the United States Constitution allows Congress to levy an income taxation without apportioning it among usa on the basis of population. It was passed past Congress in 1909 in response to the 1895 Supreme Court case of Pollock five. Farmers' Loan & Trust Co. The Sixteenth Subpoena was ratified by the requisite number of states on February iii, 1913, and effectively overruled the Supreme Court'south ruling in Pollock.

Prior to the early on 20th century, most federal acquirement came from tariffs rather than taxes, although Congress had often imposed excise taxes on diverse goods. The Revenue Act of 1861 had introduced the outset federal income tax, but that tax was repealed in 1872. During the late nineteenth century, various groups, including the Populist Party, favored the establishment of a progressive income tax at the federal level. These groups believed that tariffs unfairly taxed the poor, and they favored using the income tax to shift the revenue enhancement burden onto wealthier individuals. The 1894 Wilson–Gorman Tariff Human action contained an income taxation provision, only the tax was struck down by the Supreme Courtroom in the case of Pollock five. Farmers' Loan & Trust Co. In its ruling, the Supreme Courtroom did not concord that all federal income taxes were unconstitutional, merely rather held that income taxes on rents, dividends, and interest were direct taxes and thus had to be apportioned among the states on the basis of population.

For several years after Pollock, Congress did not endeavor to implement another income revenue enhancement, largely due to concerns that the Supreme Court would strike down any endeavour to levy an income tax. In 1909, during the debate over the Payne–Aldrich Tariff Act, Congress proposed the Sixteenth Amendment to united states of america. Though conservative Republican leaders had initially expected that the amendment would not exist ratified, a coalition of Democrats, progressive Republicans, and other groups ensured that the necessary number of states ratified the amendment. Shortly subsequently the amendment was ratified, Congress imposed a federal income revenue enhancement with the Revenue Human activity of 1913. The Supreme Courtroom upheld that income revenue enhancement in the 1916 example of Brushaber v. Union Pacific Railroad Co., and the federal regime has connected to levy an income taxation since 1913.

Text

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without circulation among the several States, and without regard to whatever census or enumeration.

Other Constitutional provisions regarding taxes

Commodity I, Department 2, Clause 3:

Representatives and direct taxes shall exist apportioned among the several States which may exist included inside this Union, co-ordinate to their corresponding Numbers...[1]

Article I, Section viii, Clause one:

The Congress shall accept Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defense force and general Welfare of the United states; merely all Duties, Imposts and Excises shall exist uniform throughout the The states.

Article I, Section ix, Clause iv:

No Capitation, or other directly, Tax shall exist laid, unless in proportion to the Census or Enumeration herein before directed to exist taken.

This clause basically refers to a tax on belongings, such as a tax based on the value of land,[2] equally well as a capitation.

Article I, Department 9, Clause 5:

No Tax or Duty shall be laid on Articles exported from whatever State.

Income taxes before the Pollock case

Until 1913, customs duties (tariffs) and excise taxes were the main sources of federal acquirement.[3] During the War of 1812, Secretary of the Treasury Alexander J. Dallas fabricated the first public proposal for an income tax, but it was never implemented.[four] The Congress did introduce an income tax to fund the Civil War through the Revenue Act of 1861.[5] Information technology levied a flat tax of three pct on almanac income above $800. This deed was replaced the following year with the Revenue Deed of 1862, which levied a graduated revenue enhancement of 3 to five percent on income above $600 and specified a termination of income tax in 1866. The Civil State of war income taxes, which expired in 1872, proved to exist both highly lucrative and drawing mostly from the more industrialized states, with New York, Pennsylvania, and Massachusetts generating about sixty pct of the total revenue that was collected.[vi] During the two decades following the expiration of the Civil War income tax, the Greenback movement, the Labor Reform Party, the Populist Party, the Democratic Party and many others called for a graduated income revenue enhancement.[half-dozen]

The Socialist Labor Party advocated a graduated income tax in 1887.[7] The Populist Party "demand[ed] a graduated income tax" in its 1892 platform.[8] The Democratic Party, led by William Jennings Bryan, advocated the income tax police force passed in 1894,[9] and proposed an income tax in its 1908 platform.[10] Proponents of the income tax by and large believed that high tariff rates exacerbated income inequality, and wanted to use the income tax to shift the burden of funding the government away from working form consumers and to high-earning businessmen.[11]

Before Pollock v. Farmers' Loan & Trust Co., all income taxes had been considered to be indirect taxes imposed without respect to geography, dissimilar straight taxes, that have to exist apportioned amid the states according to population.[12] [thirteen]

The Pollock case

In 1894, an amendment was fastened to the Wilson–Gorman Tariff Act that attempted to impose a federal taxation of two percent on incomes over $4,000 (equal to $120,000 in 2020).[fourteen] The federal income taxation was strongly favored in the Due south, and information technology was moderately supported in the eastern North Central states, simply it was strongly opposed in the Far Westward and the Northeastern States (with the exception of New Jersey).[15] The tax was derided as "un-Autonomous, inquisitorial, and wrong in principle".[16]

In Pollock v. Farmers' Loan & Trust Co., the U.South. Supreme Courtroom declared certain taxes on incomes, such equally those on property nether the 1894 Act, to exist unconstitutionally unapportioned directly taxes. The Court reasoned that a tax on income from holding should be treated as a tax on "holding by reason of its buying" then should be required to be apportioned. The reasoning was that taxes on the rents from state, the dividends from stocks, and then forth, burdened the property generating the income in the same manner that a tax on "belongings past reason of its ownership" burdened that holding.

Subsequently Pollock, while income taxes on wages (every bit indirect taxes) were however non required to be apportioned by population, taxes on interest, dividends, and rental income were required to exist apportioned by population. The Pollock ruling made the source of the income (e.g., belongings versus labor, etc.) relevant in determining whether the tax imposed on that income was deemed to exist "direct" (and thus required to be apportioned amid the states according to population) or, alternatively, "indirect" (and thus required only to be imposed with geographical uniformity).[17]

Dissenting in Pollock, Justice John Marshall Harlan stated:

When, therefore, this court adjudges, equally it does now adjudge, that Congress cannot impose a duty or taxation upon personal holding, or upon income arising either from rents of real estate or from personal property, including invested personal holding, bonds, stocks, and investments of all kinds, except by apportioning the sum to be so raised among the States according to population, it practically decides that, without an amendment of the Constitution—two-thirds of both Houses of Congress and three-fourths of the States concurring—such belongings and incomes can never be made to contribute to the support of the national authorities.[18]

Members of Congress responded to Pollock by expressing widespread concern that many of the wealthiest Americans had consolidated besides much economic power.[nineteen] All the same, in the years after Pollock, Congress did not implement some other federal income tax, partly considering many Congressmen feared that any revenue enhancement would be struck down by the Supreme Court.[20] Few considered attempting to impose an apportioned income tax, since such a revenue enhancement was widely regarded as unworkable.[21]

Adoption

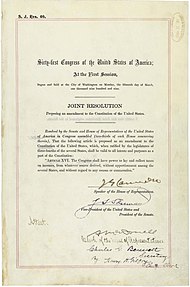

On June 16, 1909, President William Howard Taft, in an address to the Threescore-outset Congress, proposed a ii percent federal income taxation on corporations by way of an excise tax and a constitutional amendment to allow the previously enacted income revenue enhancement.

Upon the privilege of doing business organisation equally an artificial entity and of freedom from a general partnership liability enjoyed by those who own the stock.[22] [23]

An income tax amendment to the Constitution was first proposed by Senator Norris Dark-brown of Nebraska. He submitted two proposals, Senate Resolutions Nos. 25 and 39. The amendment proposal finally accepted was Senate Joint Resolution No. 40, introduced by Senator Nelson Westward. Aldrich of Rhode Island, the Senate majority leader and Finance Committee Chairman.[24] The subpoena was proposed every bit part of the congressional debate over the 1909 Payne–Aldrich Tariff Act; by proposing the amendment, Aldrich hoped to temporarily defuse progressive calls for the imposition of new taxes in the tariff act. Aldrich and other conservative leaders in Congress largely opposed the actual ratification of the amendment, but they believed that it had lilliputian chance of being ratified, as ratification required approval past three quarters of the state legislatures.[25]

On July 12, 1909, the resolution proposing the Sixteenth Amendment was passed by the Congress[26] and was submitted to the land legislatures. Back up for the income revenue enhancement was strongest in the western and southern states, while opposition was strongest in the northeastern states.[27] Supporters of the income tax believed that it would be a much better method of gathering revenue than tariffs, which were the chief source of revenue at the time. From well earlier 1894, Democrats, Progressives, Populists and other left-oriented parties argued that tariffs disproportionately affected the poor, interfered with prices, were unpredictable, and were an intrinsically limited source of acquirement. The Southward and the West tended to back up income taxes considering their residents were generally less prosperous, more agricultural and more sensitive to fluctuations in commodity prices. A sharp rise in the cost of living between 1897 and 1913 greatly increased support for the idea of income taxes, including in the urban Northeast.[28] A growing number of Republicans also began supporting the idea, notably Theodore Roosevelt and the "Insurgent" Republicans (who would go on to form the Progressive Party).[29] These Republicans were driven mainly past a fear of the increasingly large and sophisticated military machine forces of Nihon, Uk and the European powers, their own imperial ambitions, and the perceived need to defend American merchant ships.[30] Moreover, these progressive Republicans were convinced that central governments could play a positive role in national economies.[31] A bigger government and a bigger military, they argued, required a correspondingly larger and steadier source of revenue to support it.

Opposition to the Sixteenth Amendment was led by establishment Republicans because of their close ties to wealthy industrialists, although not even they were uniformly opposed to the full general idea of a permanent income tax. In 1910, New York Governor Charles Evans Hughes, shortly before becoming a Supreme Court Justice, spoke out against the income tax subpoena. Hughes supported the thought of a federal income tax, but believed the words "from whatever source derived" in the proposed amendment implied that the federal government would have the power to tax country and municipal bonds. He believed this would excessively centralize governmental power and "would go far impossible for the land to go along any property".[32]

Between 1909 and 1913, several conditions favored passage of the Sixteenth Amendment. Inflation was high and many blamed federal tariffs for the rising prices. The Republican Party was divided and weakened by the loss of Roosevelt and the Insurgents who joined the Progressive Party, a problem that blunted opposition even in the Northeast.[33] In 1912, the Democrats won the presidency and control of both houses of Congress. The country was by and large in a left-leaning mood, with a member of the Socialist Party winning a seat in the U.S. House in 1910 and the political party's presidential candidate polling six percentage of the popular vote in 1912.

Three advocates for a federal income tax ran in the presidential election of 1912.[34] On February 25, 1913, Secretary of State Philander Knox proclaimed that the amendment had been ratified by three-fourths of the states and and then had become role of the Constitution.[35] The Revenue Human action of 1913, which greatly lowered tariffs and implemented a federal income tax, was enacted before long subsequently the Sixteenth Amendment was ratified.[36]

Ratification

Co-ordinate to the United states Regime Publishing Office, the post-obit states ratified the amendment:[37]

- Alabama: August ten, 1909

- Kentucky: Feb 8, 1910

- S Carolina: February 19, 1910

- Illinois: March i, 1910

- Mississippi: March 7, 1910

- Oklahoma: March ten, 1910

- Maryland: April viii, 1910

- Georgia: August iii, 1910

- Texas: Baronial 16, 1910

- Ohio: January nineteen, 1911

- Idaho: January twenty, 1911

- Oregon: Jan 23, 1911

- Washington: January 26, 1911

- Montana: January 27, 1911

- Indiana: Jan 30, 1911

- California: January 31, 1911

- Nevada: Jan 31, 1911

- South Dakota: Feb 1, 1911

- Nebraska: Feb 9, 1911

- North Carolina: February xi, 1911

- Colorado: Feb 15, 1911

- Due north Dakota: February 17, 1911

- Michigan: Feb 23, 1911

- Iowa: February 24, 1911

- Kansas: March ii, 1911

- Missouri: March 16, 1911

- Maine: March 31, 1911

- Tennessee: April 7, 1911

- Arkansas: April 22, 1911, after having previously rejected the amendment

- Wisconsin: May 16, 1911

- New York: July 12, 1911

- Arizona: April 3, 1912

- Minnesota: June 11, 1912

- Louisiana: June 28, 1912

- West Virginia: January 31, 1913

- Delaware: February 3, 1913

Ratification (by the requisite 36 states) was completed on February 3, 1913, with the ratification by Delaware. The amendment was subsequently ratified by the following states, bringing the total number of ratifying states to forty-two[38] of the forty-eight then existing:

- New Mexico: (Feb 3, 1913)

- Wyoming: (February 3, 1913)

- New Jersey: (Feb 4, 1913)

- Vermont: (February 19, 1913)

- Massachusetts: (March 4, 1913)

- New Hampshire: (March 7, 1913), later rejecting the amendment on March 2, 1911

The legislatures of the following states rejected the amendment without ever later on ratifying it:

- Connecticut

- Rhode Island

- Utah

- Virginia[39]

The legislatures of the following states never considered the proposed subpoena:

- Florida

- Pennsylvania

Pollock overruled

The Sixteenth Amendment removed the precedent prepare by the Pollock decision.[forty] [41]

Professor Sheldon D. Pollack at the University of Delaware wrote:

On February 25, 1913, in the endmost days of the Taft administration, Secretary of State Philander C. Knox, a former Republican senator from Pennsylvania and attorney general under McKinley and Roosevelt, certified that the amendment had been properly ratified by the requisite number of state legislatures. Three more states ratified the amendment soon later on, and somewhen the total reached 42. The remaining six states either rejected the amendment or took no action at all. Notwithstanding the many frivolous claims repeatedly advanced by so-called tax protestors, the Sixteenth Amendment to the Constitution was duly ratified as of February 3, 1913. With that, the Pollock conclusion was overturned, restoring the status quo dues. Congress in one case once again had the "ability to lay and collect taxes on incomes, from whatever source derived, without circulation among the several States, and without regard to any demography or enumeration".[42]

From William D. Andrews, Professor of Law, Harvard Law School:

In 1913 the Sixteenth Amendment to the Constitution was adopted, overruling Pollock, and the Congress then levied an income tax on both corporate and individual incomes.[43]

From Professor Boris Bittker, who was a tax police professor at Yale Constabulary School:

Equally construed by the Supreme Court in the Brushaber case, the power of Congress to taxation income derives from Article I, Section 8, Clause 1, of the original Constitution rather than from the Sixteenth Subpoena; the latter merely eliminated the requirement that an income tax, to the extent that it is a direct tax, must be apportioned amongst us. A corollary of this conclusion is that whatever straight tax that is not imposed on "income" remains subject to the rule of apportionment. Considering the Sixteenth Amendment does not purport to define the term "direct tax," the telescopic of that constitutional phrase remains as debatable as it was before 1913; but the practical significance of the issue was greatly reduced once income taxes, even if direct, were relieved from the requirement of apportionment.[44]

Professor Erik Jensen at Example Western Reserve Academy Law School has written:

[The Sixteenth Amendment] was a response to the Income Tax Cases (Pollock five. Farmers' Loan & Trust Co.), and it exempts only "taxes on incomes" from the apportionment rule that otherwise applies to direct taxes.[45]

Professor Calvin H. Johnson, a tax professor at the University of Texas School of Constabulary, has written:

The Sixteenth Amendment to the Constitution, ratified in 1913, was written to permit Congress to tax income without the hobbling apportionment requirement.... Pollock was itself overturned by the Sixteenth Amendment as to apportionment of income...[46]

From Gale Ann Norton:

Courts have substantially abandoned the permissive interpretation created in Pollock. Subsequent cases have viewed the Sixteenth Amendment as a rejection of Pollock's definition of "direct tax". The apportionment requirement again applies just to real estate and capitation taxes. Even if the Sixteenth Subpoena is not viewed as narrowing the definition of directly taxes, it at to the lowest degree introduces an boosted consideration to assay under the Apportionment Clause. For the Court to strike an unapportioned revenue enhancement, plaintiffs must establish non merely that a tax is a direct revenue enhancement, but also that it is not in the subset of directly taxes known as an income taxation.[47]

From Alan O. Dixler:

In Brushaber, the Supreme Court validated the first mail - 16th Subpoena income tax. Chief Justice White, who equally an associate justice had dissented articulately in Pollock, wrote for a unanimous Court. Upholding the income tax provisions of the tariff act of Oct 3, 1913, Chief Justice White observed that the 16th Amendment did not give Congress whatever new power to lay and collect an income tax; rather, the 16th Amendment permitted Congress to exercise so without apportionment...[48]

Congress may impose taxes on income from any source without having to apportion the total dollar amount of tax collected from each state according to each state's population in relation to the full national population.[49]

In Wikoff 5. Commissioner, the The states Revenue enhancement Court said:

[I]t is immaterial, with respect to Federal income taxes, whether the tax is a straight or an indirect taxation. Mr. Wikoff [the taxpayer] relied on the Supreme Courtroom's decision in Pollock v. Farmers' Loan & Trust Co.... simply the upshot of that decision has been nullified by the enactment of the 16th Amendment.[50]

In Abrams five. Commissioner, the Tax Courtroom said:

Since the ratification of the Sixteenth Amendment, it is immaterial with respect to income taxes, whether the tax is a straight or indirect tax. The whole purpose of the Sixteenth Amendment was to relieve all income taxes when imposed from [the requirement of] apportionment and from [the requirement of] a consideration of the source whence the income was derived.[51]

Necessity of amendment

In the tardily 19th century and early 20th century, many legal observers believed that the Supreme Courtroom had erred in designating some income taxes as direct taxes. The Supreme Court had previously rejected the argument that income taxes constituted direct taxes in Springer v. United States (1881).[52] Some legal scholars continue to question whether the Supreme Court ruled correctly in Pollock,[53] only others debate that the original meaning of direct taxes did indeed include income taxes.[54]

Instance law

The federal courts' interpretations of the Sixteenth Subpoena accept changed considerably over fourth dimension and there have been many disputes about the applicability of the amendment.

The Brushaber case

In Brushaber 5. Union Pacific Railroad, 240 U.Due south. i (1916), the Supreme Court ruled that (ane) the Sixteenth Amendment removes the Pollock requirement that sure income taxes (such as taxes on income "derived from real property" that were the subject of the Pollock determination), be apportioned among the states co-ordinate to population;[55] (2) the federal income taxation statute does not violate the Fifth Subpoena'southward prohibition against the government taking belongings without due process of law; (iii) the federal income tax statute does not violate the Article I, Department 8, Clause1 requirement that excises, as well known every bit indirect taxes, be imposed with geographical uniformity.

The Kerbaugh-Empire Co. case

In Bowers v. Kerbaugh-Empire Co., 271 U.S. 170 (1926), the Supreme Courtroom, through Justice Pierce Butler, stated:

It was not the purpose or the effect of that subpoena to bring whatever new field of study within the taxing power. Congress already had the ability to tax all incomes. But taxes on incomes from some sources had been held to be "direct taxes" inside the meaning of the constitutional requirement as to apportionment. [citations omitted] The Subpoena relieved from that requirement and obliterated the stardom in that respect between taxes on income that are direct taxes and those that are not, so put on the same footing all incomes "from whatever source derived". [citations omitted] "Income" has been taken to mean the same affair every bit used in the Corporation Excise Taxation of 1909 (36 Stat. 112), in the Sixteenth Amendment, and in the various acquirement acts after passed. [citations omitted] Afterwards full consideration, this court declared that income may be defined as proceeds derived from uppercase, from labor, or from both combined, including profit gained through sale or conversion of capital letter.

The Glenshaw Drinking glass case

In Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955), the Supreme Court laid out what has become the modernistic agreement of what constitutes "gross income" to which the Sixteenth Subpoena applies, declaring that income taxes could be levied on "accessions to wealth, conspicuously realized, and over which the taxpayers accept consummate dominion". Under this definition, any increase in wealth—whether through wages, benefits, bonuses, sale of stock or other property at a profit, bets won, lucky finds, awards of punitive amercement in a lawsuit, qui tam actions—are all inside the definition of income, unless the Congress makes a specific exemption, every bit information technology has for items such as life insurance gain received by reason of the expiry of the insured party,[56] gifts, bequests, devises and inheritances,[57] and sure scholarships.[58]

Income tax of wages, etc.

Federal courts have ruled that the Sixteenth Amendment allows a direct tax on "wages, salaries, commissions, etc. without circulation".[59]

The Penn Mutual case

Although the Sixteenth Subpoena is often cited as the "source" of the congressional ability to tax incomes, at least 1 court has reiterated the bespeak made in Brushaber and other cases that the Sixteenth Amendment itself did not grant the Congress the ability to tax incomes, a power the Congress had since 1789, simply only removed the possible requirement that any income tax exist apportioned amid the states according to their corresponding populations. In Penn Mutual Indemnity, the United states of america Taxation Court stated:[60]

In dealing with the scope of the taxing power the question has sometimes been framed in terms of whether something can be taxed every bit income under the Sixteenth Amendment. This is an inaccurate conception... and has led to much loose thinking on the subject. The source of the taxing power is not the Sixteenth Amendment; it is Article I, Section eight, of the Constitution.

The Us Courtroom of Appeals for the Tertiary Circuit agreed with the Tax Court, stating:[61]

It did not take a ramble amendment to entitle the United States to impose an income taxation. Pollock v. Farmers' Loan & Trust Co., 157 U. South. 429, 158 U. Southward. 601 (1895), only held that a tax on the income derived from existent or personal property was and so shut to a taxation on that property that it could not exist imposed without apportionment. The Sixteenth Amendment removed that bulwark. Indeed, the requirement for apportionment is pretty strictly express to taxes on real and personal property and capitation taxes.

It is non necessary to uphold the validity of the tax imposed past the United States that the tax itself acquit an accurate label. Indeed, the tax upon the distillation of spirits, imposed very early past federal authority, now reads and has read in terms of a revenue enhancement upon the spirits themselves, even so the validity of this imposition has been upheld for a very cracking many years.

Information technology could well exist argued that the tax involved here [an income tax] is an "excise taxation" based upon the receipt of coin by the taxpayer. It certainly is non a tax on property and it certainly is not a capitation tax; therefore, information technology demand non be apportioned. We do not think information technology profitable, however, to make the label equally precise every bit that required under the Food and Drug Human action. Congress has the power to impose taxes generally, and if the particular imposition does non run afoul of any constitutional restrictions then the taxation is lawful, phone call information technology what y'all volition.

The Irish potato example

On December 22, 2006, a iii-gauge console of the United states Court of Appeals for the Commune of Columbia Circuit vacated[62] its unanimous decision (of August 2006) in Murphy five. Internal Revenue Service and Us.[63] In an unrelated thing, the courtroom had likewise granted the government's motion to dismiss Murphy'south arrange against the Internal Revenue Service. Under federal sovereign amnesty, a taxpayer may sue the federal regime, merely not a government agency, officer, or employee (with some exceptions). The Court ruled:

Insofar every bit the Congress has waived sovereign immunity with respect to suits for tax refunds under , that provision specifically contemplates but actions against the "U.s.a.". Therefore, nosotros agree the IRS, unlike the United states of america, may not be sued eo nomine in this example.

An exception to federal sovereign immunity is in the United states Tax Court, in which a taxpayer may sue the Commissioner of Internal Revenue.[64] The original 3-guess panel then agreed to rehear the example itself. In its original decision, the Courtroom had ruled that was unconstitutional under the Sixteenth Amendment to the extent that the statute purported to tax, equally income, a recovery for a nonphysical personal injury for mental distress and loss of reputation not received in lieu of taxable income such every bit lost wages or earnings.

Because the August 2006 opinion was vacated, the Court of Appeals did non hear the example en banc.

On July iii, 2007, the Court (through the original three-judge panel) ruled (1) that the taxpayer'southward compensation was received on account of a nonphysical injury or sickness; (2) that gross income under department 61 of the Internal Revenue Code[65] does include compensatory damages for nonphysical injuries, fifty-fifty if the award is non an "accretion to wealth", (3) that the income tax imposed on an honour for nonphysical injuries is an indirect tax, regardless of whether the recovery is restoration of "human upper-case letter", and therefore the tax does not violate the ramble requirement of Article I, Section 9, Clause iv, that capitations or other direct taxes must be laid amid us but in proportion to the population; (iv) that the income taxation imposed on an honor for nonphysical injuries does not violate the constitutional requirement of Article I, Section eight, Clause 1, that all duties, imposts and excises be uniform throughout the United states of america; (5) that under the doctrine of sovereign immunity, the Internal Acquirement Service may not be sued in its ain name.[66]

The Court stated that "[a]lthough the 'Congress cannot brand a thing income which is not and then in fact',... it tin label a thing income and tax information technology, so long equally it acts inside its constitutional authority, which includes not only the Sixteenth Amendment simply also Article I, Sections 8 and9."[67] The court ruled that Ms. Tater was not entitled to the tax refund she claimed, and that the personal injury award she received was "within the achieve of the Congressional ability to tax nether Article I, Section8 of the Constitution" fifty-fifty if the award was "non income within the meaning of the Sixteenth Amendment".[68] Come across also the Penn Mutual case cited above.

On Apr 21, 2008, the U.S. Supreme Courtroom declined to review the conclusion by the Courtroom of Appeals.[69]

See too

- Tax protester Sixteenth Amendment arguments

Notes

- ^ Knowlton five. Moore 178 U.Due south. 41 (1900) and Flint v. Rock Tracy Co. 220 U.South. 107 (1911)

- ^ Hylton v. United States iii U.South. 171 (1796)

- ^ Buenker, John D. 1981. "The Ratification of the Sixteenth Subpoena". The Cato Periodical. 1:1. PDF

- ^ Baack, Bennet T. and Edward John Ray. 1985. "Special Interests and the Adoption of the Income Taxation in the United States". The Journal of Economical History 5. 45, No. 3. pp. 607-625.

- ^ "On This Mean solar day: Congress Passes Deed Creating Outset Income Tax". Findingdulcinea.com. Retrieved March 26, 2012.

- ^ a b Baack and Ray, p. 608.

- ^ "Socialist Labor Political party Platform" (PDF) . Retrieved March 26, 2012.

- ^ "Populist Party Platform, 1892". Historymatters.gmu.edu. Retrieved March 26, 2012.

- ^ Bryan, William Jennings (1909). Speeches of William Jennings Bryan, pp. 159-179 . Retrieved March 26, 2012.

- ^ 1908 Democratic party platform Archived January thirteen, 2008, at the Wayback Machine

- ^ Weisman 2002, p. 137–138

- ^ Commentary, James W. Ely, Jr., on the case of Springer five. United States, in answers.com, at [1]

- ^ "Again the state of affairs is aptly illustrated by the various acts taxing incomes derived from holding of every kind and nature which were enacted commencement in 1861, and lasting during what may be termed the Civil War menses. Information technology is not disputable that these latter tax laws were classed under the caput of excises, duties, and imposts because it was causeless that they were of that grapheme, although putting a taxation burden on income of every kind, including that derived from property real or personal, since they were not taxes directly on belongings because of its ownership." Brushaber v. Marriage Pac. Railroad, 240 U.S. 1 (1916), at 15

- ^ 1634–1699: McCusker, J. J. (1997). How Much Is That in Real Money? A Historical Price Alphabetize for Use as a Deflator of Money Values in the Economic system of the United States: Addenda et Corrigenda (PDF). American Antiquarian Society. 1700–1799: McCusker, J. J. (1992). How Much Is That in Real Money? A Historical Price Alphabetize for Utilise as a Deflator of Money Values in the Economic system of the United States (PDF). American Antiquarian Society. 1800–present: Federal Reserve Bank of Minneapolis. "Consumer Price Index (estimate) 1800–". Retrieved January 1, 2020.

- ^ Baack and Ray, p. 610

- ^ "Mr. Cockran'south Last Endeavor" (PDF). New York Times. January 31, 1894.

- ^ Read a clarification of the decision at the Tax History Museum Archived 2010-08-14 at the Wayback Machine

- ^ "Justice Harlan'south dissenting opinion in Pollock". Constabulary.cornell.edu. Retrieved March 26, 2012.

- ^ See the quotes from Theodore Roosevelt at the Taxation History Museum Archived 2010-08-14 at the Wayback Machine

- ^ Weisman 2002, p. 177

- ^ Jensen, Erik Grand. (2014). "DID THE SIXTEENTH Subpoena Always Thing? DOES IT Thing TODAY?". Northwestern University Police Review. 108 (three): 804, 809–810.

- ^ "Special Bulletin | The American Presidency Project". www.presidency.ucsb.edu . Retrieved October 28, 2020.

- ^ President Taft Presidential addresses. 1910. p. 166. Retrieved March 26, 2012 – via Internet Archive.

june 16 1909 income tax.

- ^ Volume 36, Statutes at Large, 61st Congress Session I, Senate Articulation Resolution No. twoscore, p. 184, approved July 31, 1909

- ^ Weisman, Steven R. (2002). The Nifty Tax Wars: Lincoln to Wilson-The Fierce Battles over Money That Transformed the Nation . Simon & Schuster. pp. 228, 233–234. ISBN0-684-85068-0. }

- ^ Senate Joint Resolution 40, 36 Stat. 184.

- ^ "The Ratification of the Federal Income Tax Subpoena, John D. Buenker" (PDF). Archived from the original (PDF) on January 14, 2012. Retrieved March 26, 2012.

- ^ Buenker, p. 186.

- ^ Buenker, p. 189

- ^ Baack and Jay, p. 613-614

- ^ Buenker, p. 184

- ^ "Arthur A. Ekirch, Jr., "The Sixteenth Amendment: The Historical Groundwork," p. 175, Cato Journal, Vol. 1, No. 1, Spring 1981" (PDF). Archived from the original (PDF) on January 14, 2012. Retrieved March 26, 2012.

- ^ Buenker, pp. 219-221

- ^ Adam Young, "The Origin of the Income Taxation", Ludwig von Mises Plant, Sept. 7, 2004

- ^ "FindLaw: U.S. Constitution: Amendments". FindLaw. Retrieved March 26, 2012.

- ^ Weisman 2002, pp. 230–232, 278–282

- ^ "Ratification of Ramble Amendments". U.S. Constitution Online. Retrieved April xx, 2012. .

- ^ See Senate Document # 108-17, 108th Congress, 2nd Session, The Constitution of the Usa of America: Analysis and Interpretation: Analysis of Cases Decided by the Supreme Court of the U.s. to June 28, 2002, at pp. 33–34, footnote 8, Congressional Research Service, Library of Congress, U.South. Gov't Printing Office (2004).

- ^ "Virginia Business firm Opposes Federal Clause by 54 to 37", The Washington Post, March viii, 1910.

- ^ Boris Bittker, "Ramble Limits on the Taxing Power of the Federal Government," The Tax Lawyer, Fall 1987, Vol. 41, No. one, p. 3 (American Bar Association) (Pollock case "was in outcome reversed by the sixteenth amendment")

- ^ "The Sixteenth Amendment to the Constitution overruled Pollock..." Graf v. Commissioner, 44 T.C.Thousand. (CCH) 66, TC Memo. 1982-317, CCH December. 39,080(M) (1982).

- ^ Sheldon D. Pollack, "Origins of the Modernistic Income Tax, 1894-1913," 66 Tax Lawyer 295, 323-324, Winter 2013 (Amer. Bar Ass'n) (footnotes omitted; italics in original).

- ^ William D. Andrews, Basic Federal Income Revenue enhancement, p. 2, Little, Chocolate-brown and Company (3d ed. 1985).

- ^ Boris I. Bittker, Martin J. McMahon, Jr. and Lawrence A. Zelenak, Federal Income Taxation of Individuals (2d ed. 2006) (accent added).

- ^ Erik Grand. Jensen, "The Taxing Power, The Sixteenth Amendment, And the Meaning of 'Incomes'", October. 4, 2002, Tax Analysts (footnotes not reproduced).

- ^ Calvin H. Johnson, "Purging Out Pollock: The Constitutionality of Federal Wealth or Sales Taxation", December. 27, 2002, Tax Analysts.

- ^ Gale Ann Norton, "The Limitless Federal Taxing Power," Vol. 8 Harvard Journal of Law and Public Policy 591 (Summer, 1985) (footnotes omitted).

- ^ Alan O. Dixler, "Straight Taxes Under the Constitution: A Review of the Precedents", Nov. 20, 2006, Tax Analysts.

- ^ "Findlaw: Sixteenth Subpoena, History and Purpose of the Amendment". Caselaw.lp.findlaw.com. Retrieved March 26, 2012.

- ^ Wikoff v. Commissioner, 37 T.C.M. (CCH) 1539, T.C. Memo. 1978-372 (1978).

- ^ 82 T.C. 403, CCH Dec. 41,031 (1984)

- ^ Jensen (2014), pp. 807–808

- ^ Jensen (2014), pp. 800–801

- ^ Jensen (2014), p. 809

- ^ "As construed past the Supreme Courtroom in the Brushaber case, the ability of Congress to tax income derives from Article I, Section viii, Clauseone of the Constitution, rather than from the Sixteenth Amendment; the latter simply eliminated the requirement that an income tax, to the extent that it is a direct revenue enhancement, must exist apportioned among u.s.." Boris I. Bittker, Martin J. McMahon, Jr. & Lawrence A. Zelenak, Federal Income Taxation of Individuals, ch. 1, paragr. 1.01[1] [a], Inquiry Plant of America (2nd ed. 2005), as retrieved from 2002 WL 1454829 (W. M. & L.).

- ^ 26 U.s.C. § 101.

- ^ 26 U.s.a.C. § 102.

- ^ 26 U.S.C. § 117.

- ^ Parker v. Commissioner, 724 F.2nd 469, 84-1 U.S. Tax Cas. (CCH) ¶ 9209 (5th Cir. 1984) (endmost parenthesis in original has been omitted). For other courtroom decisions upholding the taxability of wages, salaries, etc. see U.s.a. v. Connor, 898 F.2d 942, xc-1 U.Due south. Tax Cas. (CCH) ¶ 50,166 (3d Cir. 1990); Perkins v. Commissioner, 746 F.2d 1187, 84-2 U.S. Tax Cas. (CCH) ¶ 9898 (sixth Cir. 1984); White v. U.s.a., 2005-one U.South. Taxation Cas. (CCH) ¶ 50,289 (6th Cir. 2004), cert. denied, ____ U.S. ____ (2005); Granzow 5. Commissioner, 739 F.2d 265, 84-2 U.Southward. Tax Cas. (CCH) ¶ 9660 (7th Cir. 1984); Waters v. Commissioner, 764 F.2nd 1389, 85-2 U.South. Tax Cas. (CCH) ¶ 9512 (11th Cir. 1985); United States 5. Buras, 633 F.2d 1356, 81-i U.S. Taxation Cas. (CCH) ¶ 9126 (9th Cir. 1980).

- ^ Penn Common Indemnity Co. v. Commissioner, 32 T.C. 653 at 659 (1959), aff'd, 277 F.second 16, 60-1 U.South. Revenue enhancement Cas. (CCH) ¶ 9389 (3d Cir. 1960).

- ^ Penn Mutual Indemnity Co. 5. Commissioner, 277 F.2d sixteen, threescore-1 U.S. Tax Cas. (CCH) ¶. 9389 (3d Cir. 1960) (footnotes omitted).

- ^ Social club, December. 22, 2006, the ruling of Murphy v. Internal Revenue Service and Usa, U.Southward. Court of Appeals for the District of Columbia Circuit.

- ^ 460 F.3d 79, 2006-2 U.Southward. Tax Cas. (CCH) ¶ 50,476, 2006 WL 2411372 (D.C. Cir. August 22, 2006).

- ^ (Murphy 5. U.s.)

- ^ 26 U.Southward.C. § 61 (Murphy v United states, on rehearing)

- ^ Opinion on rehearing, July iii, 2007, Murphy v. Internal Acquirement Service and Us, case no. 05-5139, U.Due south. Court of Appeals for the District of Columbia Circuit, 2007-2 U.S. Tax Cas. (CCH) ¶ 50,531 (D.C. Cir. 2007)

- ^ Opinion on rehearing, July 3, 2007, p. xvi, Murphy v. Internal Acquirement Service and United States, case no. 05-5139, U.S. Court of Appeals for the Commune of Columbia Excursion, 2007-2 U.S. Tax Cas. (CCH) ¶ 50,531 (D.C. Cir. 2007).

- ^ Stance on rehearing, July 3, 2007, p. 5-six, Murphy five. Internal Revenue Service and United States, case no. 05-5139, U.S. Courtroom of Appeals for the District of Columbia Excursion, 2007-two U.South. Tax Cas. (CCH) ¶ fifty,531 (D.C. Cir. 2007).

- ^ Denniston, Lyle (Apr 21, 2008). "Court to hear anti-dumping, sentencing cases". SCOTUSblog. Retrieved April 21, 2008.

External links

- Official Transcript of the 16th Amendment

- Sixteenth Amendment and 1913 tax render course

- CRS Annotated Constitution: Sixteenth Amendment

- Pollock Decision

- Brushaber Determination

- Stanton Decision

Source: https://en.wikipedia.org/wiki/Sixteenth_Amendment_to_the_United_States_Constitution#:~:text=Unratified%20Amendments%3A&text=The%20Sixteenth%20Amendment%20(Amendment%20XVI,on%20the%20basis%20of%20population.

Post a Comment for "Us Cnstitutional Amendment Agains Timposing Income Tax"